Introduction

Experian, a leading global information services company, plays a crucial role in helping consumers and businesses manage their credit and risk. With its operations spanning over 37 countries, Experian’s influence in the areas of credit reporting, data analytics, and fraud prevention is significant. The importance of understanding how Experian functions is more relevant than ever in today’s financial landscape, where credit scores heavily influence access to loans and mortgages.

Experian’s Role in Credit Reporting

Founded in 1980 and headquartered in Dublin, Ireland, Experian has established itself as one of the top credit reporting agencies alongside Equifax and TransUnion. It provides credit reports to consumers and businesses, allowing them to assess and manage creditworthiness. In recent years, Experian has leveraged technology to offer insights and solutions that cater to a diverse range of industries, including finance, telecommunications, and insurance.

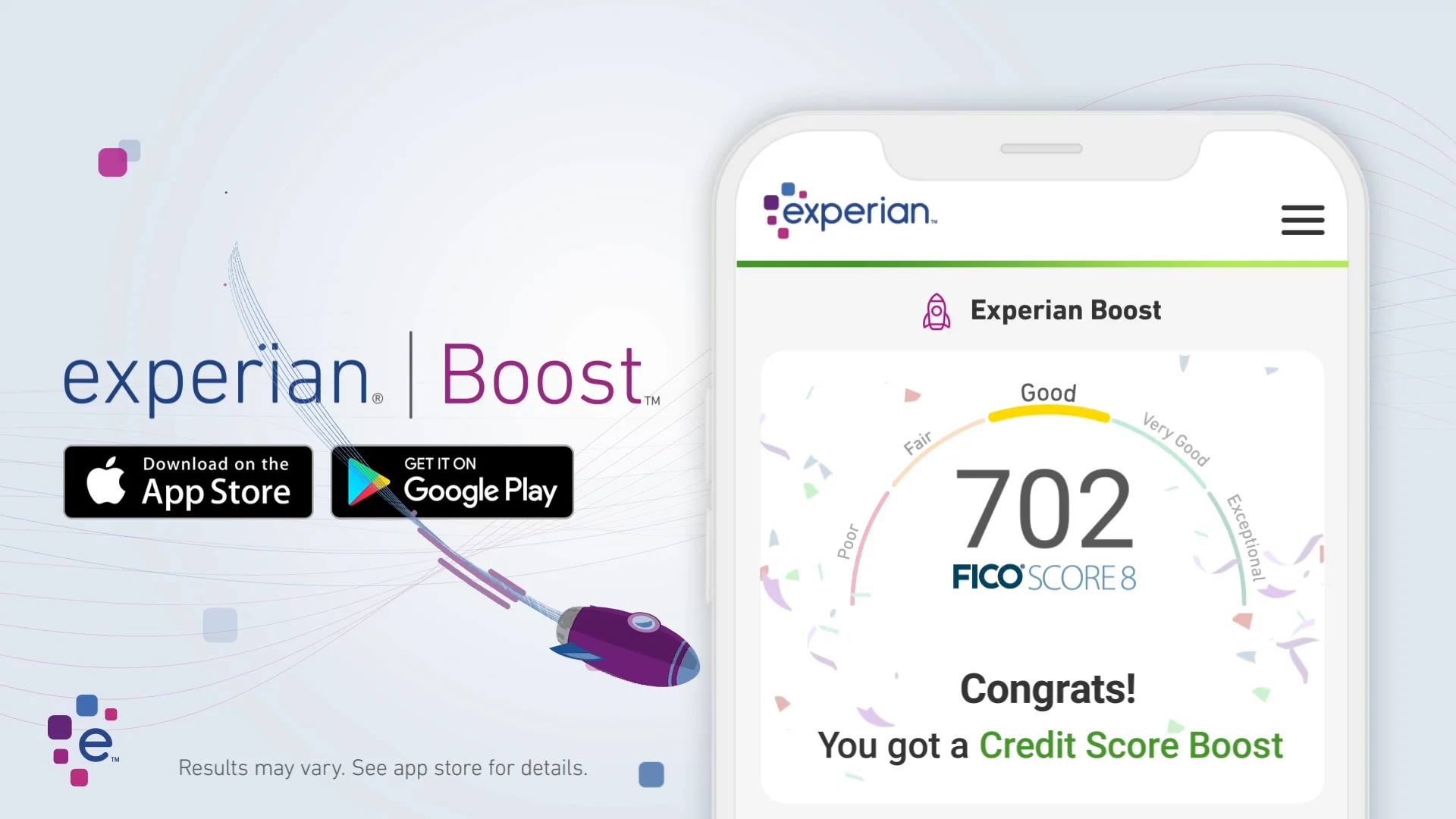

According to Experian’s latest report, the average FICO score in the UK has seen a gradual rise, currently sitting at 404, reflecting an increasing number of consumers maintaining healthy credit profiles. The company also introduced services like Experian Boost, which allows consumers to add positive payment history from utility and phone bills to their credit files, promoting financial inclusivity.

Expanding Services Beyond Credit Reporting

In addition to credit reporting, Experian provides a suite of services, including identity theft protection and data breach recovery tools, which have become increasingly essential as digital transactions rise. As cyber threats grow, Experian has invested in data security initiatives to protect personal and corporate information, highlighting its commitment to consumer safety.

Conclusion

In summary, Experian’s contributions to credit reporting and data management are monumental, particularly as we navigate an evolving economic environment. As consumers become more aware of their credit scores’ impact on financial decisions, services like those offered by Experian will continue to grow in significance. The company’s expansion into new technologies and services underscores its role in enhancing financial empowerment and security for individuals and businesses alike.