Introduction

Inflation remains a vital economic indicator that influences everything from consumer purchasing power to monetary policy decisions. The year 2026 is expected to witness significant fluctuations in inflation rates, driven by various factors such as global economic recovery, supply chain challenges, and government policies. Understanding these dynamics is crucial for businesses, investors, and consumers alike, making inflation predictions for 2026 a topic of great interest.

Current Economic Context

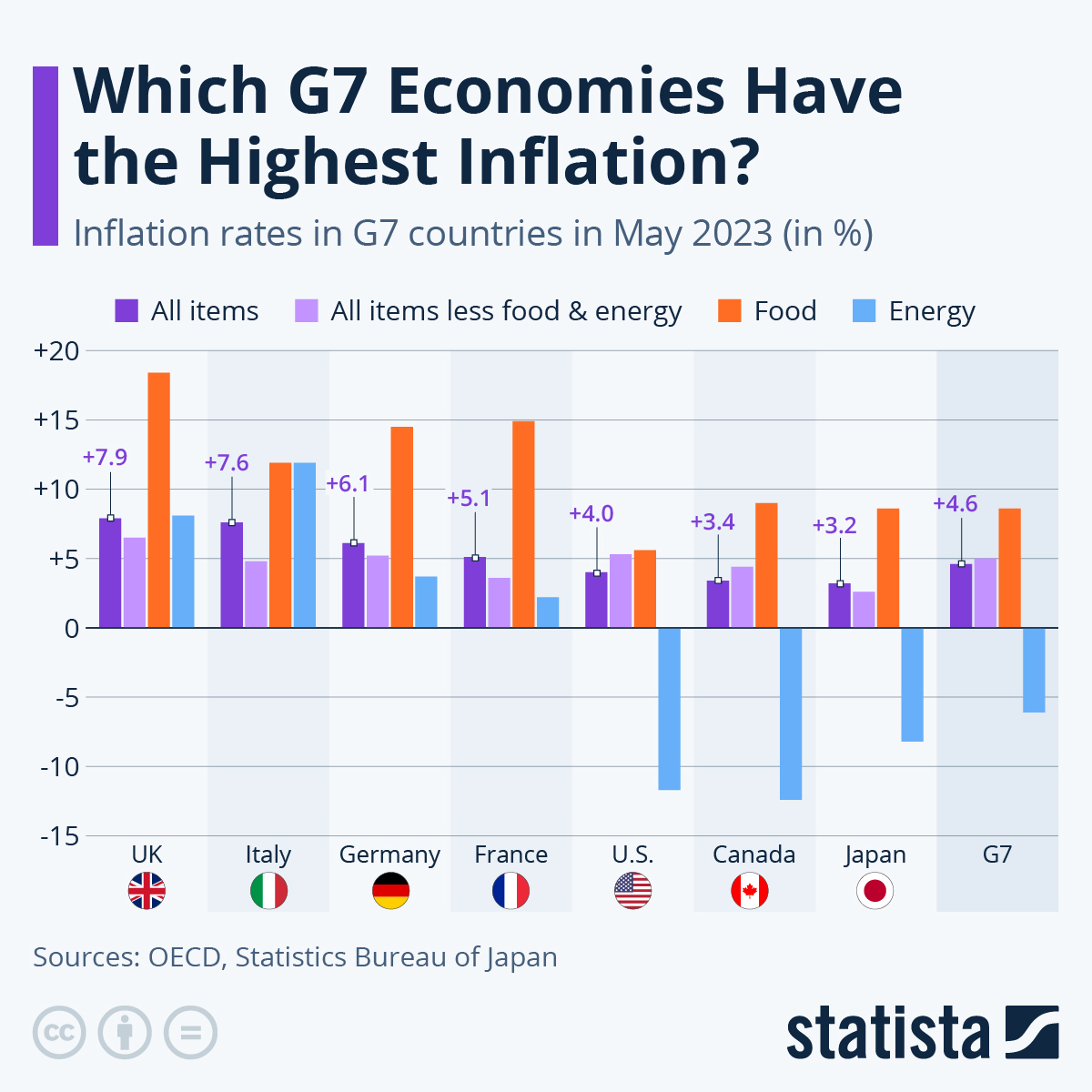

As of 2023, many countries are grappling with elevated inflation rates as a result of pandemic-related disruptions and subsequent economic recovery. In the UK, inflation had reached levels not seen in decades, prompting the Bank of England to implement interest rate hikes to rein in soaring prices. Economists are now looking ahead to 2026, estimating that while some inflationary pressures may ease, the recovery phase will introduce new challenges.

Factors Influencing Inflation in 2026

Several key factors are expected to influence inflation rates in 2026. These include:

- Global Supply Chain Recovery: As supply chains slowly stabilise post-pandemic, the costs of goods may start to reduce, but this is contingent on geopolitical factors and market stability.

- Consumer Demand Resurgence: Following the pandemic, a surge in consumer demand, especially in travel and leisure sectors, could lead to inflationary pressures if supply cannot keep up.

- Monetary Policy Adjustments: Central banks have already signalled a commitment to controlling inflation through interest rate adjustments, which could either curb inflation or stifle growth.

Predictions and Impacts

Forecasts for UK inflation rate in 2026 suggest a gradual decline from the peaks experienced in 2022 and 2023, with estimates ranging from 2.5% to 3.5%. While this is a relative improvement, the potential for spikes due to unforeseen global events remains a concern. Additionally, the long-term impacts of fiscal policies rolled out as a response to the pandemic could continue to shape inflation dynamics beyond 2026.

Conclusion

Understanding the trajectories of inflation in 2026 is essential for strategising individual and corporate financial plans. As various factors intertwine to shape economic conditions, stakeholders must remain vigilant of policy changes, market dynamics, and consumer behaviours to navigate potential inflationary landscapes effectively. As the global economy continues to adapt to ongoing challenges, the importance of accurate inflation forecasts grows ever more critical.