Introduction

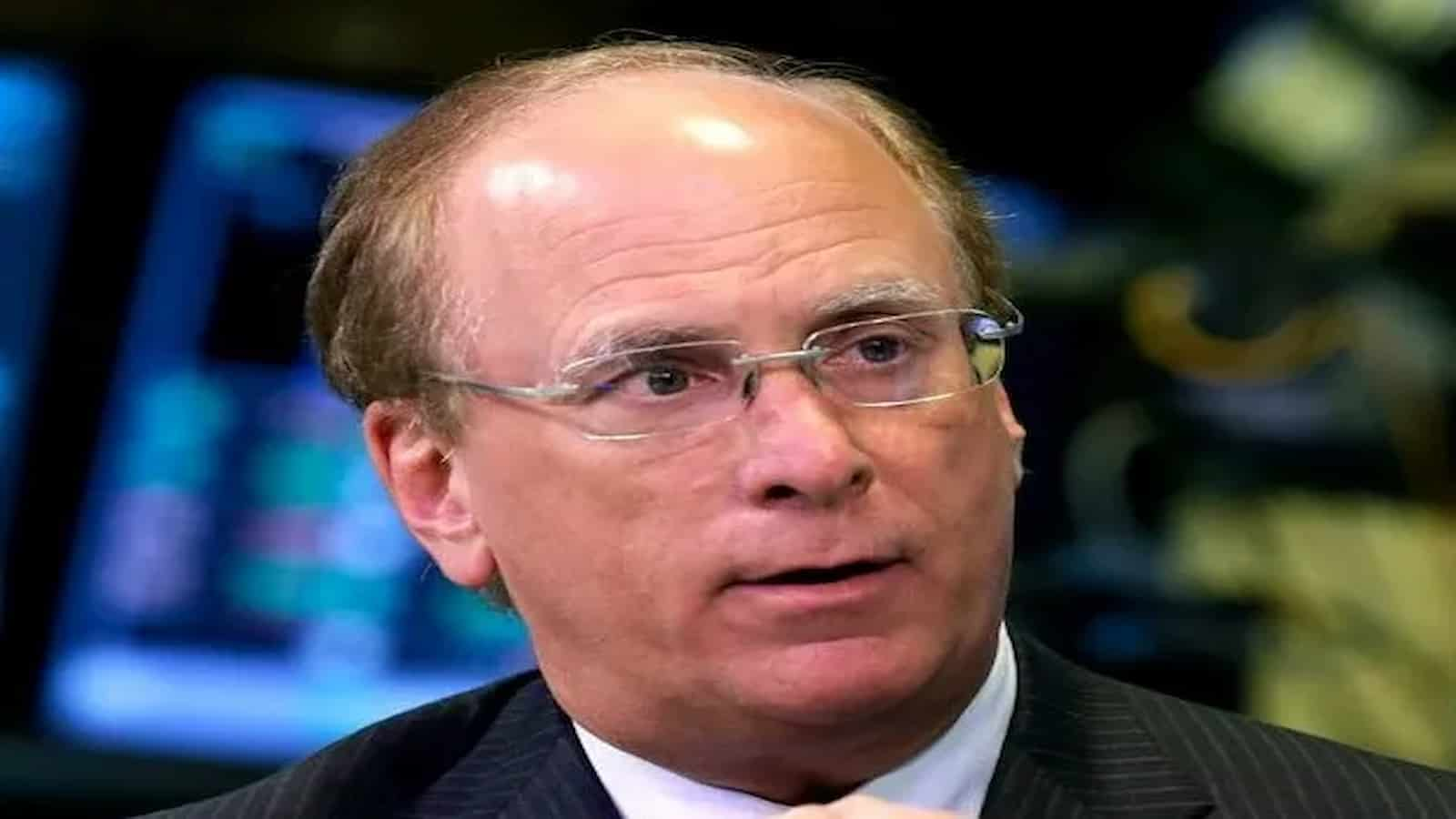

Larry Fink, co-founder and CEO of BlackRock, is a pivotal figure in the world of finance and corporate governance. His influence is particularly notable in the realms of sustainable investing and shareholder accountability. As the head of the world’s largest asset manager with over $10 trillion in assets under management, Fink’s annual letters to CEOs have become highly anticipated events, shaping the dialogue surrounding corporate responsibility and environmental sustainability.

The Power of Influence

Fink’s approach to corporate governance emphasises the importance of long-term strategies over short-term gains. In his 2023 letter, he reiterated the critical role that sustainability plays in business resilience and financial performance. “The future will be determined by those who embrace sustainability as a business strategy,” he wrote, highlighting the growing expectations from investors and stakeholders alike.

In recent years, Fink has voiced concerns about climate change, urging companies to plan for a carbon-neutral economy. His advocacy for sustainability has not only propelled BlackRock into a leadership position within the industry but has also influenced global standards for corporate governance.

Recent Developments

In light of the ongoing climate crisis, Fink has spearheaded initiatives at BlackRock to increase transparency in companies’ sustainability practices. This year, BlackRock launched a new framework aimed at reducing greenhouse gas emissions across its investment portfolio. Furthermore, the firm has introduced sustainability-focused investment products, allowing clients to align their portfolios with environmental goals.

Additionally, Fink’s willingness to engage with various stakeholders, including environmental activists and governments, showcases his commitment to balancing shareholder interests with societal needs. This includes dialogues during global forums where he advocates for responsible capitalism.

Conclusion

As the landscape of corporate governance continues to evolve, Larry Fink remains at the forefront of this transformation. His leadership at BlackRock signifies a shift in investment philosophies towards sustainability and corporate accountability. Observers predict that the strategies and principles championed by Fink will substantially shape the future of investing, compelling more firms to adopt socially responsible practices as a norm rather than an exception. For investors and consumers alike, understanding Fink’s vision for corporate governance is crucial, as it will likely influence their choices in an increasingly conscientious market.