Introduction

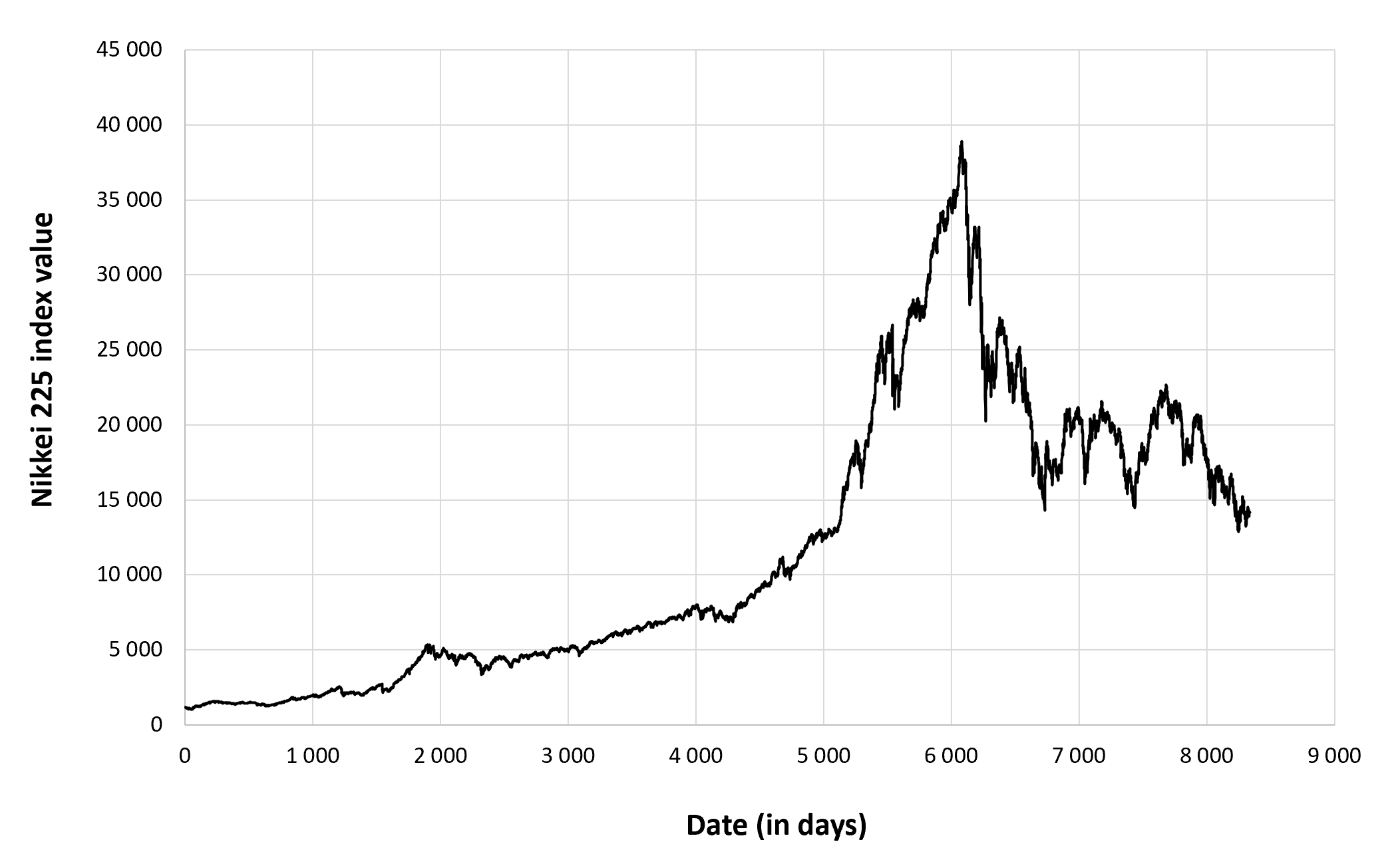

The Nikkei 225, also known as the Nikkei Stock Average, is Japan’s premier stock market index. It is crucial for investors and analysts as it reflects the performance of the top 225 large companies listed on the Tokyo Stock Exchange (TSE). Given Japan’s position as the third-largest economy in the world, fluctuations in the Nikkei 225 can serve as a barometer for global economic stability, making it an important topic within financial news.

Recent Trends

As of late 2023, the Nikkei 225 has experienced notable volatility, driven primarily by various domestic and international factors. Over the past month, the index has fluctuated between 28,000 and 30,000 points, showing resilience despite challenges such as rising inflation rates, changes in global interest rates, and geopolitical tensions. The index showed a decline of approximately 2% last week, attributed in part to investors’ caution over pending economic data releases and the uncertainty surrounding global trade dynamics.

Influences on the Market

One of the primary drivers of the recent performance of the Nikkei 225 is Japan’s economic policy. The Bank of Japan’s (BoJ) stance on interest rates remains pivotal. Following a prolonged period of ultra-low interest rates, any indication that the BoJ may shift its policy from its current negative interest rate environment could significantly impact stock valuations. Investors are closely monitoring these developments, along with the fiscal measures implemented by the Japanese government, which include stimulus packages aimed at bolstering domestic demand.

Internationally, the Nikkei 225 is subject to the influence of U.S. markets, given their intertwined economies. Recent downturns in the U.S. stock market due to tech sector sell-offs have reverberated through the Nikkei, illustrating the interconnectedness of global financial markets.

Conclusion

In summary, the Nikkei 225 remains a crucial indicator of Japan’s economic landscape and a significant measure for global investors. Forecasts suggest that the index might continue to experience fluctuations as the market reacts to both domestic and international economic signals. For investors and analysts, keeping an eye on the Nikkei provides essential insights into not only Japan’s economic health but also the broader trends in the global financial market. Understanding these dynamics is vital for making informed investment decisions and anticipating potential market shifts.