Introduction

The Barclays share price is a critical indicator of the financial health and market perception of one of the UK’s leading banks. As investors seek to understand the market’s ebb and flow, monitoring the fluctuations in Barclays’ stock becomes essential. With economic uncertainties and increasing interest rates impacting financial institutions, the analysis of Barclays’ share price offers insights into the company’s stability and growth potential.

Current Share Price Trends

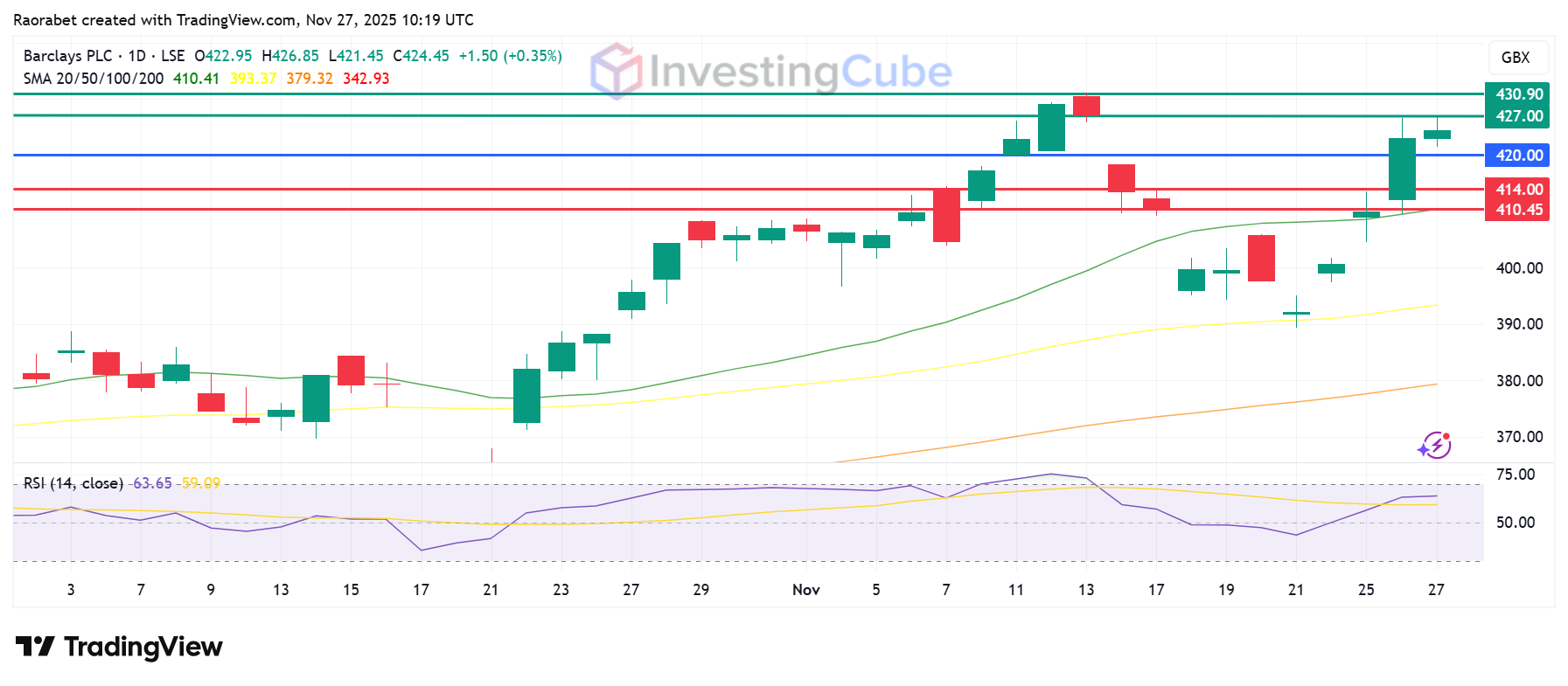

As of October 2023, Barclays shares are experiencing notable volatility amid market uncertainties. Recent data shows that the share price has been fluctuating between £1.80 and £2.10 over the last month, reflecting broader economic conditions and sectoral influences. Analysts attribute this volatility to various factors, including the Bank of England’s interest rate policies, inflation concerns, and competitive pressures in the banking sector.

On October 15, 2023, Barclays declared its third-quarter trading update, revealing a net profit rise of 12% year-on-year. This announcement resulted in a temporary uptick in the share price, highlighting the market’s positive reaction to the bank’s robust performance in the current financial climate.

Factors Influencing Share Price

Several critical factors influence the movement of Barclays share price. These include:

- Economic Indicators: As an international bank, Barclays is sensitive to changes in global economic conditions. Economic indicators such as consumer confidence, unemployment rates, and GDP growth directly impact banking operations and profitability.

- Regulatory Changes: Regulatory decisions, particularly those involving capital reserves and lending practices, can significantly affect share prices. Recent discussions about stricter capital requirements for banks could prompt a cautious response from investors.

- Market Sentiment: Overall investor sentiment towards the banking sector has been fluctuating. Following successful stress tests and positive quarterly reports, Barclays’ reputation is gradually improving, leading to increased investment confidence.

Conclusion

In summary, keeping an eye on Barclays share price is crucial for investors navigating the tumultuous waters of the finance sector. While current trading data indicates some stability, external pressures may lead to more fluctuations in the near future. Financial analysts recommend that potential investors conduct thorough due diligence and monitor economic indicators closely. As the landscape evolves, Barclays’ share price will continue to reflect the bank’s ability to adapt to changing market conditions and investor expectations.