Introduction

The stock market plays a pivotal role in the global economy, serving as a barometer for investor sentiment and corporate performance. Understanding its dynamics is crucial for individuals and institutions looking to invest wisely. Over recent months, the stock market has experienced significant fluctuations, influenced by various economic factors, geopolitical tensions, and changing consumer behaviour.

Recent Trends

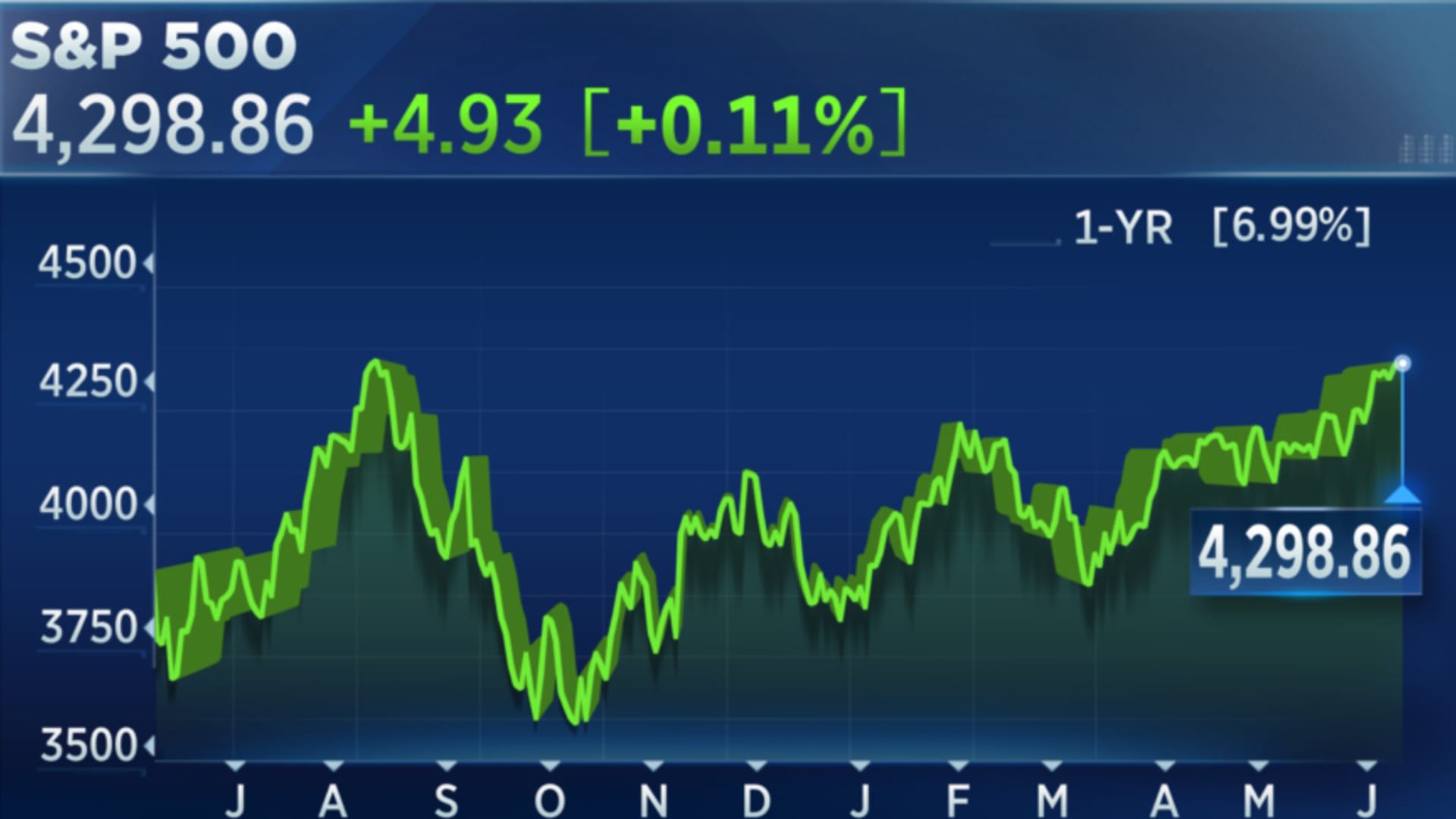

As of October 2023, the stock market has seen a surge in volatility, prompting many analysts to reassess their predictions. August and September recorded mixed results with indices like the FTSE 100 and the S&P 500 showing signs of recovery after a turbulent first half of the year. Stocks in the technology sector, in particular, have rebounded sharply, aided by growing demand for AI and cloud technologies.

Moreover, interest rate decisions by central banks, including the Bank of England and the Federal Reserve, have heavily influenced market movements. Recently, these institutions have maintained a cautious stance on interest rates, trying to balance inflation concerns while supporting economic growth. This uncertainty has led to fluctuating bond yields, further impacting stock performance.

Market Influences

Geopolitical tensions, including ongoing conflicts in Eastern Europe and trade relations with China, have also added layers of complexity to the stock market landscape. Investors are closely monitoring these events, weighing their potential impacts on global supply chains and economic stability. The energy sector, for instance, has been particularly volatile, responding to fluctuations in oil prices influenced by these global events.

Additionally, earnings reports from major corporations have provided mixed signals. While some sectors, like consumer goods, have demonstrated resilience amid economic challenges, others have struggled with supply chain disruptions. As we move closer to the end of the fiscal quarter, many investors are keenly focused on upcoming earnings reports, which may provide insights into future market trajectories.

Conclusion

The stock market remains a complex and ever-evolving landscape. For investors and analysts alike, the key to navigating these uncertain waters lies in staying informed about current trends, understanding the underlying economic indicators, and anticipating potential shifts. Looking ahead, the ongoing geopolitical and economic developments are likely to dictate market performance in the coming months. For readers, it’s important to remain vigilant and informed to make educated decisions in this dynamic environment.